I have taught Consumer Math at the high school level for several years now. 10 years ago I was at a different high school and when the district decided to implement a senior level course for math credit, I jumped at the chance to teach it. At that time, there were few materials for teachers and the curriculum was pieced together based on what several of us termed as “important” skills for soon-to-be adults to have.

Then I transferred to the middle school and Consumer Math was assigned to teachers who viewed it as a punishment. After all, most math teachers aspire to teach honors classes or Algebra 2 classes and not a lower level math class.

However, I always believed that of all the math classes taught, Consumer Math was the most needed by our young people to be successful adults. Subjects such as the difference between simple and compound interest, budgeting, investment and insurance options are vital for an informed public. I would like to see this class as required for all students—at least one semester.

Resources for Teen Finance

When I returned to teaching at the high school I was assigned Consumer Math again. I did not ask for it. I was wise enough to know that people rarely receive what they ask for so I asked for something else. However, much has changed in the last 10 years. Now there are a variety of resources online to support teaching personal finance to teens. Some of these resources are free while others have an annual fee.

Money Instructor

https://www.moneyinstructor.com/

$$ Lessons and worksheets on a variety of topics. You can customize the worksheets with names of students. This is especially fun with paycheck stubs.

Quia

$$ This site has a lot of useful online resources to help students on all subjects. There are quizzes, vocabulary options, puzzles and games. This site has been around for a long time and my first discovery of how using online resources can help students learn.

The beauty of this site is that you can make your own resources or search the shared resources that other teachers have made. You can usually find something to use or at least something to use as a starting point. The most popular type of activity is the game for 2 which is similar to “Who Wants To Be A Millionaire”. Students want to know if they will get their million and I direct them to the principal.

Next Gen Personal Finance

FREE This is by far my favorite resource this year. The site has a pacing guide for semester and shorter terms and complete lesson plans with articles, videos, discussion questions and more. I copy the lesson plans for students to a google doc and assign through google classroom. Also available are posters, games (real arcade games) and additional topics to stimulate thinking.

The lesson plans vary from 45 minutes to 90 minutes. There are stimulating questions you can use in class. My school has an extra 20 minutes in one of the periods where teachers deliver additional lessons to extend learning. Several teachers are using these resources just for fun.

Consumer Math

https://www.basic-mathematics.com/consumer-math.html

FREE This is probably more suited to lower grades but it does have some good examples on the site as well as worksheets. Some concepts are more difficult for students and finding quality resources is a problem. Net Pay and Gross Pay are such subjects which this site has.

Consumer Math

$$ The units are well-arranged and could be assigned as they are. You can get a free trial and purchase software to keep track of scores. The material is also arranged by personal finance and business finance and enough material to teach 20 weeks of each area. I did try the site out free and found the materials worthwhile, but my school does not pay for memberships like this.

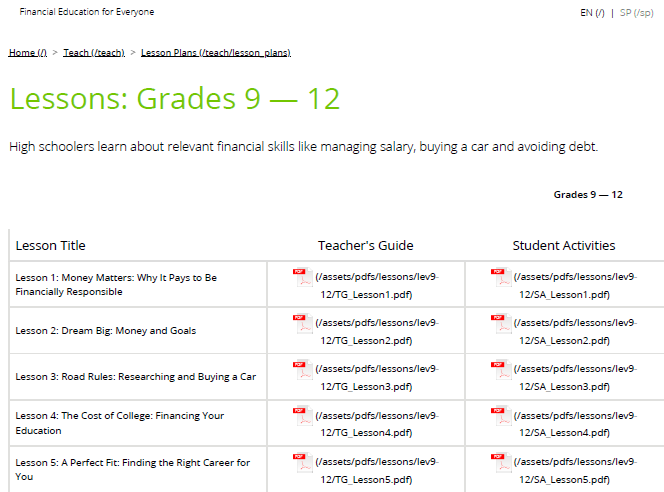

Practical Money Skills

https://www.practicalmoneyskills.com/teach/lesson_plans

FREE 22 Lessons with both a student guide and teachers guide. You can choose the grade level in case you incorporate lessons into middle school or elementary. Since many concepts in Consumer Math require percents and decimals, this makes interesting real-life examples for students of all ages.

Stock Market Game

In addition to these resources, my students play the stock market game in the spring. It is free to play, students are assigned to teams where they invest $100,000 in stocks and bonds. Games have different periods of time to play. I like the spring game which starts in January and lasts until early April.

I alternate this with other activities in investments, savings, retirement and interest. Kids are used to playing video games where the action is quick and over in a few minutes. For many students, waiting for weeks to see stocks go up or down a few cents is painful. The site also has an option to participate in a essay contest.

https://www.stockmarketgame.org/

And of course I am creating some activities that will complement the concepts we study. I like using Boom Cards in the classroom, so I have decks for net pay, gross pay and sales tax in my TPT store. I am working on several more for the coming weeks. Students also enjoy the paper chains which are self-checking and make great decorations in the classroom. If you want to be notified of new resources as they are created, click the link below and follow my store. This way you will stay up to date.

https://www.teacherspayteachers.com/Sellers-Im-Following/Add/Blue-Mountain-Math

Please let me know if you have any other favorite resources for teaching personal finance to teens. And if you have not tried some of these out, check them out and let me know how it goes. Drop a comment below of email me at [email protected].

Thanks so much for the review!! I wish schools would stop doing our kids a disservice require consumer math in school.

I really enjoyed this post on Consumer Math! The practical examples you provided make it much easier to grasp how personal finance works. I especially appreciated the tips on budgeting and saving for future goals. Looking forward to seeing more content like this!

I really enjoyed this post on consumer math! The practical tips on budgeting and managing expenses are incredibly helpful. It’s great to see such important topics being discussed in a relatable way. Looking forward to more insights!

This post on consumer math and personal finance is incredibly insightful! I love how it breaks down complex concepts into easily digestible pieces. It’s so important for us to understand these principles to better manage our finances. Thanks for sharing these valuable tips!

This post on Consumer Math and Personal Finance is incredibly helpful! I love how it breaks down complex concepts into understandable terms. The practical examples make it easier to apply these lessons to everyday life. Looking forward to more insights like this!

This blog post on Consumer Math and Personal Finance is incredibly insightful! I love how you break down complex topics into easily understandable concepts. The practical tips for budgeting and saving are especially helpful. Looking forward to more posts like this!

I really enjoyed this post! The practical tips on consumer math and personal finance are so helpful for making everyday financial decisions. The examples you provided made the concepts easy to understand. Looking forward to more insightful content like this!

I really enjoyed this post on Consumer Math! It’s so helpful to see practical examples of personal finance concepts. The tips on budgeting and saving are applicable to everyday life, and I appreciate the clear explanations. Looking forward to more posts like this!

I really enjoyed this post! It’s refreshing to see practical applications of consumer math laid out clearly. The budgeting tips and explanations of interest rates were especially helpful. Looking forward to more insights on managing personal finances!

This post was incredibly insightful! The practical examples of consumer math made the concepts really relatable. I’m definitely going to apply some of these strategies to manage my personal finances better. Thanks for sharing!

Great insights on consumer math! The practical examples really helped me understand how to apply these concepts in real life. Looking forward to more posts like this!

This post on Consumer Math and Personal Finance is incredibly insightful! I appreciated the practical tips and examples you provided; they truly demystify complex concepts. It’s so important for us to understand how to manage our finances effectively. Thank you for making this accessible and engaging!

Great insights on consumer math! I appreciate how you broke down the concepts in a relatable way. Understanding budgeting and personal finance is so crucial for everyone, and this post makes it accessible. Keep up the great work!

Great insights on Consumer Math and Personal Finance! I love how you broke down complex topics into easily digestible pieces. This is definitely going to help me make more informed financial decisions. Looking forward to more posts like this!

This blog post on Consumer Math and Personal Finance is incredibly insightful! I love how you broke down complex topics into easy-to-understand concepts. The practical examples really helped me grasp how to apply these skills in real life. Keep up the great work!

Great insights on managing personal finance! I especially appreciated the practical examples of budgeting and saving strategies. It’s so important to equip ourselves with these skills for a secure financial future. Looking forward to more tips on consumer math!

I really enjoyed this post! The practical examples of consumer math applications made the concepts much easier to understand. It’s a great reminder of how important personal finance education is. Looking forward to more tips and strategies in future posts!