Spring is coming and in my Consumer Math class it is time again for the Stock Market Game. Last year I learned a lot about how to scaffold the lessons so it would be more meaningful. Last year I played along and lost my virtual money.

In case you are not familiar with the Stock Market game, it is a free simulation of the New York Stock Exchange that is played across the country. Did I mention it is FREE? There are videos and tutorials for new users. Teachers register for one of the many sessions that is played during the school year and receive team log in information when the game is about to begin.

Rules of the Game

The rules are simple, but I like to make them a little more structured. Each team has $100,000 to spend in the market. I model how to log in, make a purchase and warn them about overspending. Yes, you can overspend, you can spend up to $150,000 but that extra $50,000 will cost you interest because it is a loan. You pay 2% brokers fees on both purchases and sales, so no churning of your account if you want to win.

More than a Game

I think there is a prize for winning, but my teams have never come close. It isn’t their fault, it is mine. While I understand the rules, I play to win from a different perspective. This class is consumer math and we learn about personal finance. I use the stock market game as a tool to teach investment strategies. I teach them about stocks, bonds, mutual funds and long term diversification. It’s about the compound interest.

There is more that just the trading. There is a InvestWrite which is an essay contest. There is also the Capitol Hill Challenge which is for Title 1 Schools and the top 10 teams win a trip to Washington D.C. to meet with their member of the House of Representatives.

You can keep it simple or you can take advantage of all the resources the site offers. The first few times I have played, I adapted the resources to teach my students about stocks and what it means to buy a “share”. Students were still confused and I felt the lesson did not go deep enough. This was years ago and perhaps my knowledge of the stock market was not that good. And resources were not as plentiful.

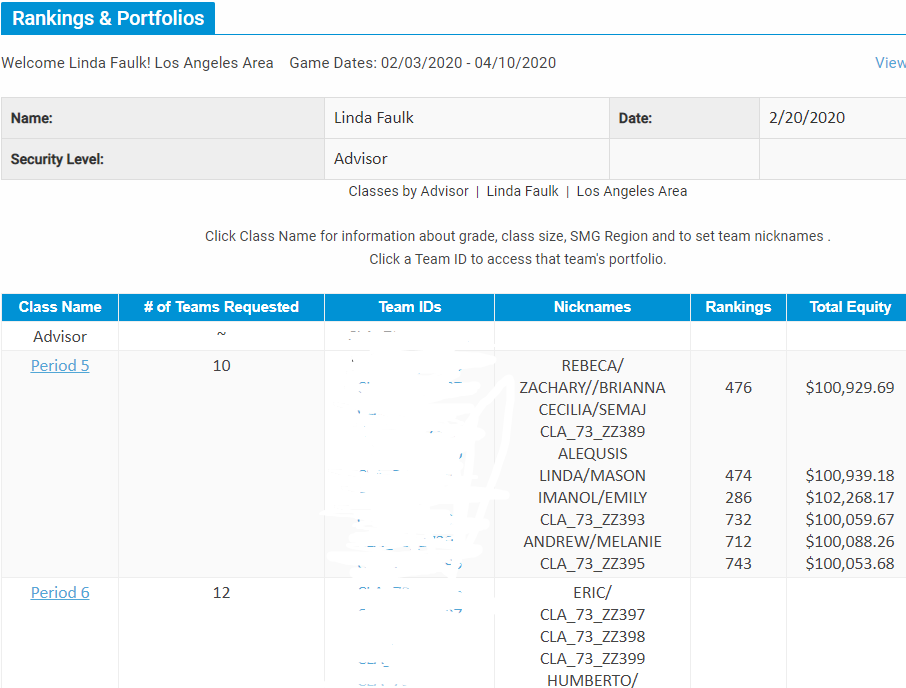

Team Standings

Above is the team standings from this past week. We have been playing for 2 weeks now. Students are very reluctant to spend their virtual cash and afraid of losing money. I model how to place a trade and then show them how to check their account holdings.

My Additional Rules

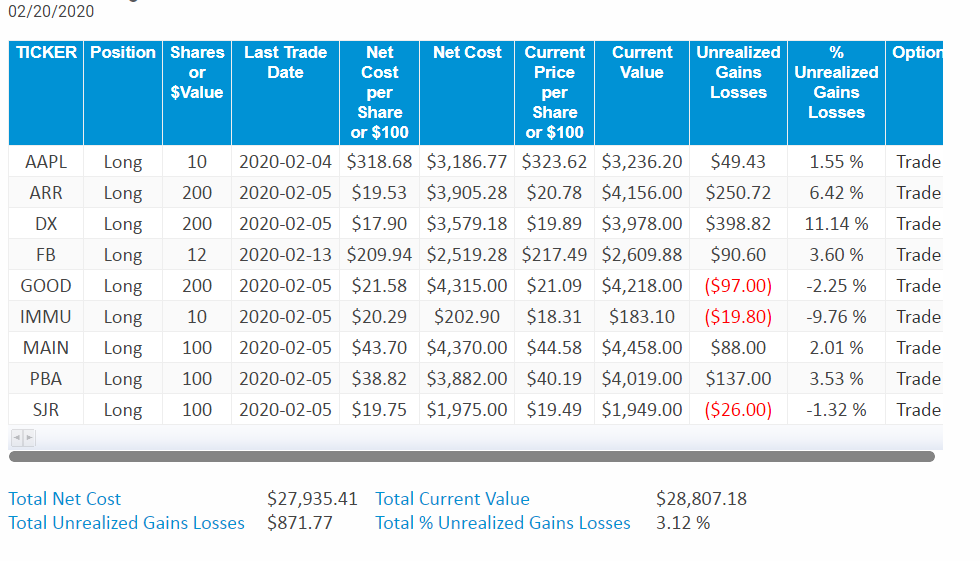

I also require students to keep track of their holdings on a spreadsheet and calculate the total costs by adding in the brokers fees. In a few weeks, we will calculate the return on investment for each of their stocks. I also have a targeted goal for each week in the game period. This weeks goal was to buy $3000 of two different mutual funds. This means students had to research mutual funds, find the share price and calculate the number of shares to buy to meet the goal.

These are the stock in one of the accounts. I admit to cheating a little. If an account is doing well, I check to see what the students purchased. After all, I am always looking for a good stock tip. But I tell students not to share stock tips with others, they are playing to have the highest account at the end of the season, if not the highest in the the region, at least the top in our school. Bragging rights of course. And the game includes a certificate of participation which I fill out and hand to the students at the end of the season.

Resources that Complement the Game

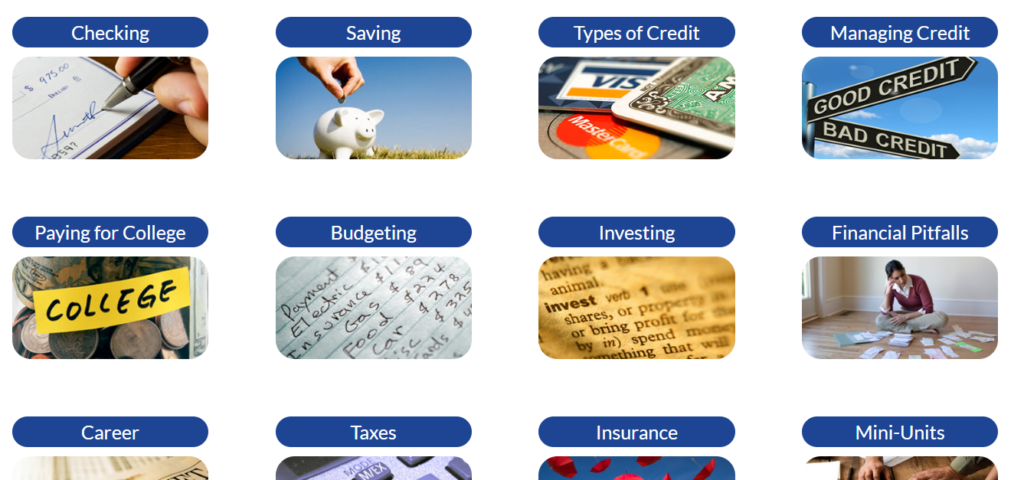

When I first had students playing years ago, a teacher was dependent on resources in the stock market game. They are good, and there are lots of them for all age groups. But I felt as a teacher, my students would have understood more if I had delivered better lessons. Now I supplement the resources in the stock market game from the units in the Next Generation Personal Finance curriculum.

It’s FREE. Yes, another free resource for consumer math. The units are great and a wide variety of topic. They have full lessons on google sheets, assessments (in google forms), videos, games and activities. Discussion questions begin each lesson to stimulate thinking. There are 45 minutes lessons and longer lessons.

For Investing, the site has a variety of lessons on stocks, investment basics, mutual funds, bonds and investing for retirement. I alternate lessons with playing the simulation for a hands on experience of each lesson.

Because I do not have school resources for Consumer Math, I was lucky to stumble across the website above to add to my curriculum. It has supplemented my modules on taxes, college expenses and Insurance. One of my favorite mini-lessons is on identity theft and scams to avoid. The FinCap Friday combines a 5 question competition with a quick video to engage students. If you are teaching a personal finance class or just want to add some spice to some of your lessons check our these resources.

Leave a Reply